carried interest tax reform

Iii increase the funding for the Internal Revenue Service the IRS and other governmental tax functions. Raising taxes on carried interest capital gains should be rejected.

1 But these modifications are not new.

. Carried interest also referred to as the carry which might entail 20 of the funds profits over a set period typically annual with the exception of private equity funds. And iv increase investment in. Carried interest is a loophole in the United States tax code that has stood out for its egregious unfairness and stunning longevity.

The grant of a carried interest without liquidation value would continue to be tax-free but holders would need to take into account a three-year holding period to obtain the preferential tax rate of long-term capital gains treatment. US Senate Democrats agree to 14bn carried interest tax reform Earlier efforts to reform carried interest taxation had stalled before US Senator Joe Manchin announced on Wednesday that he and Senate Majority Leader Chuck Schumer had worked out a deal. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of.

The grant of a carried interest without liquidation value would continue to be tax-free but holders would need to take into account a three-year holding period to obtain the preferential tax rate. Its usually tied to a specified rate of return known as profits over. It is a terrible tax policy that would harm economic growth reduce jobs and reduce the returns of public pension funds across the country.

Carried interest isnt guaranteed. The carried interest tax is a direct attack on the structure of partnerships that are used by innovative businessesfrom small firms to venture capital and angel investors that take risks and make an outsized contribution to economic growth and job creation. Kyrsten Sinema D-Ariz has previously opposed increasing taxes on carried interest capital gains according to reporting.

Democrats have proposed raising taxing carried interest capital gains. The government ruling coalition in December 2020 agreed to an outline of tax reform proposals for 2021including clarification of the income tax treatment of distributions of profit received by fund managers carried interest. Carried interest should receive capital gains tax treatment because it represents a return on an underlying long-term capital asset as well as risk and entrepreneurial activity.

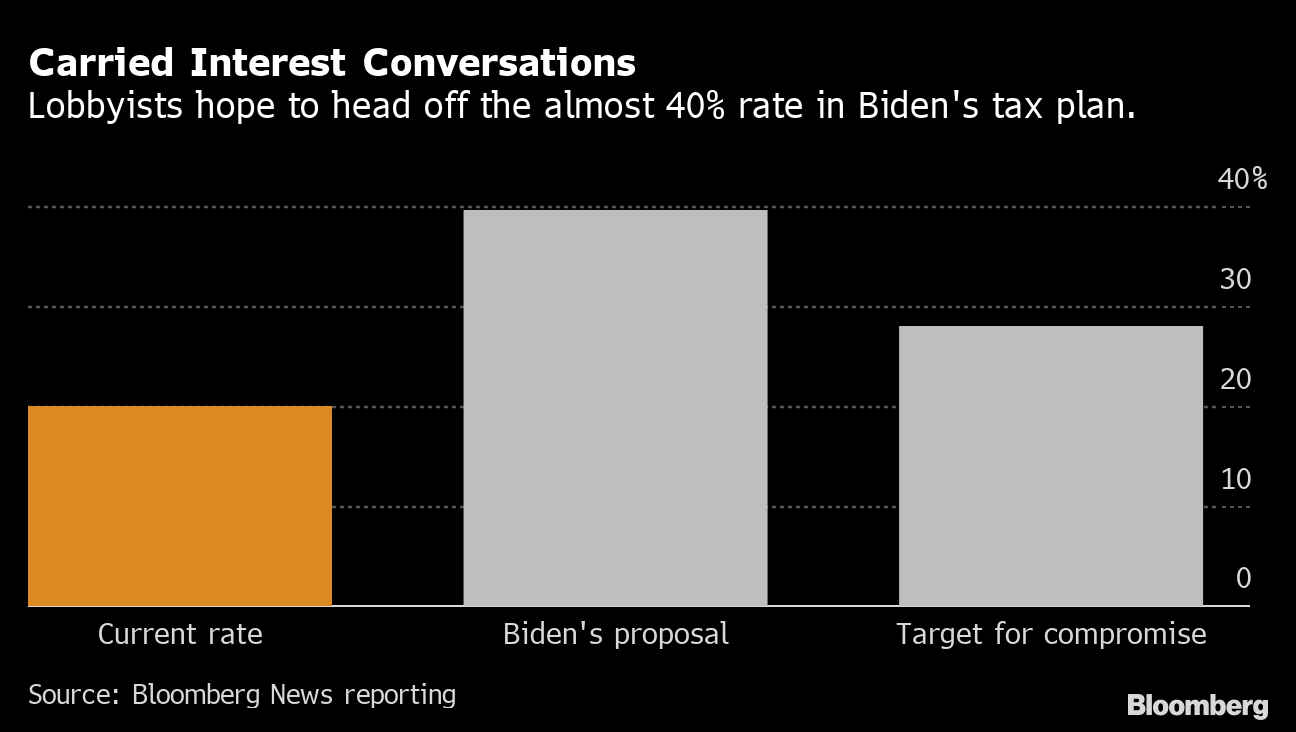

Tax Reform 322021 While the future of carried interest and long-term capital gain tax rates may remain in flux we do have clarity on required holding periods. But closing the so-called carried interest loophole by taxing private equity profits at personal income rates instead of at lower capital gains rates is. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that.

While titled the Inflation Reduction Act of 2022 the Inflation Reduction Act buried in the bill to the surprise of many is a revenue raiser fixed on making certain modifications to existing Section 1061 which may significantly change how carried interest is taxed. Ii create a new corporate minimum tax. Its only created when the fund generates profits.

The 725-page revival called the Inflation Reduction Act of 2022 the Act contains tax proposals that. In January 2021 the US. Review new regulations before assessing your tax situation.

Chamber of Commerces Center for Capital Markets Competitiveness. I change the tax treatment of carried interests. Key insights The IRS issued final regulations under Section 1061 that provide much-needed clarity on carried interests.

09082021 Raising taxes on carried interest capital gains will eliminate 49 million jobs and cause pension funds to lose 3 billion per year according to a new study by the US. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free. By Alexander Bolton - 080522 152 PM ET Senate Majority Leader Charles Schumer D-NY says he had no choice but to remove a provision closing the so-called carried interest tax loophole for.

This is in contrast to any fees that managing partners receive in payment for operations and management activities which are taxed as ordinary income.

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

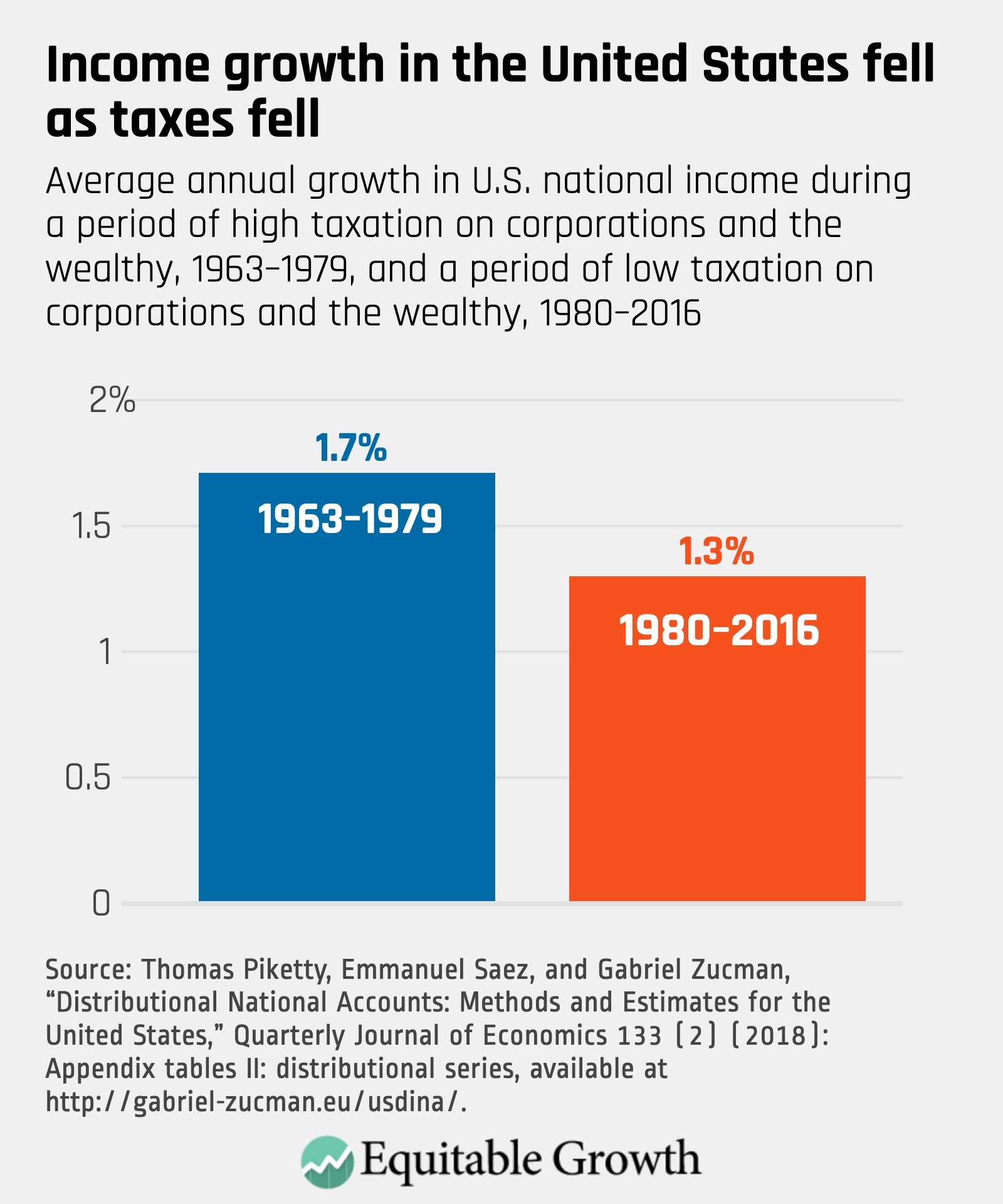

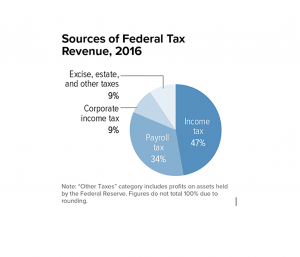

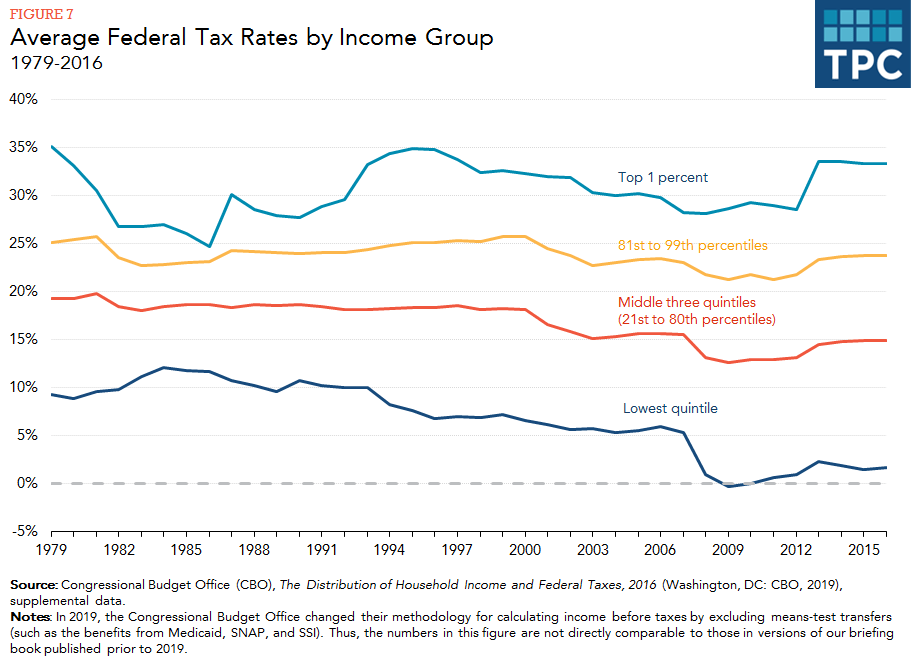

The Relationship Between Taxation And U S Economic Growth Equitable Growth

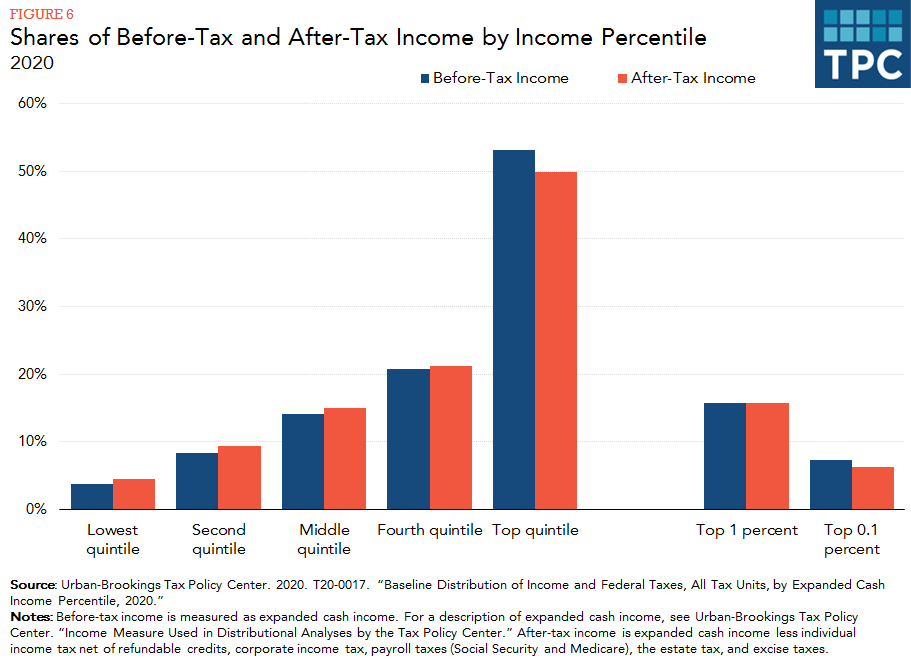

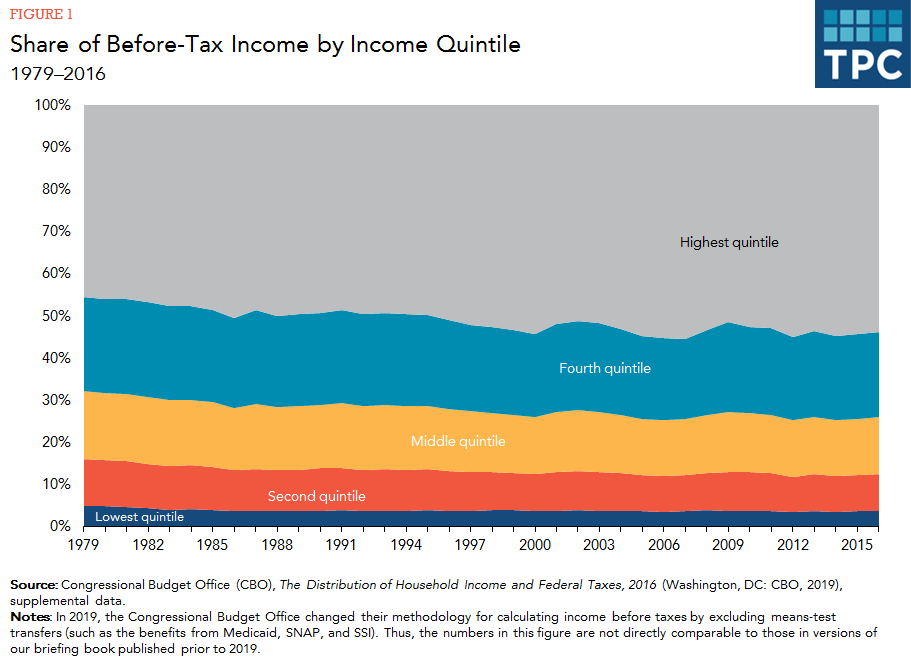

How Do Taxes Affect Income Inequality Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do Taxes Affect Income Inequality Tax Policy Center

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do Taxes Affect Income Inequality Tax Policy Center

How To Tax Capital Without Hurting Investment The Economist

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

How Should Progressivity Be Measured Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

:strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)