carried interest tax loophole

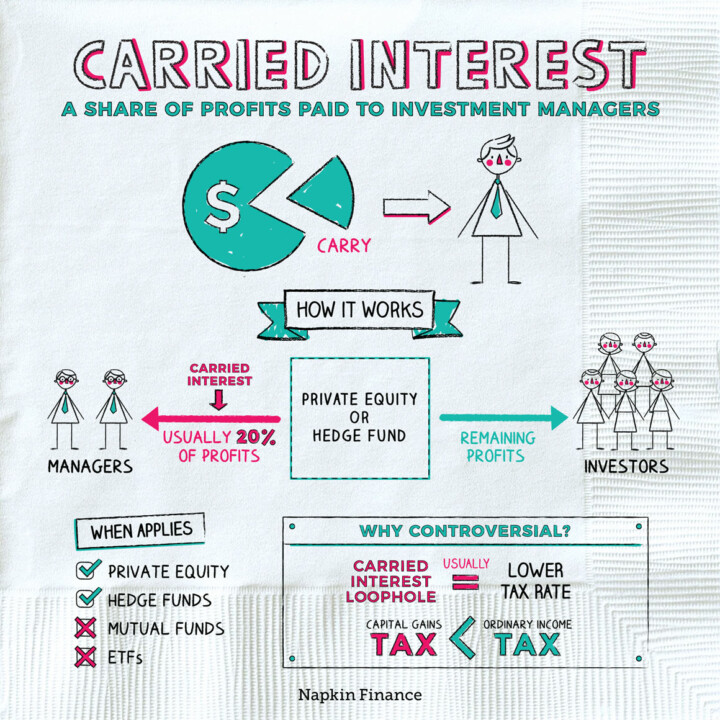

If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed. 3 Examples of Tax Loopholes.

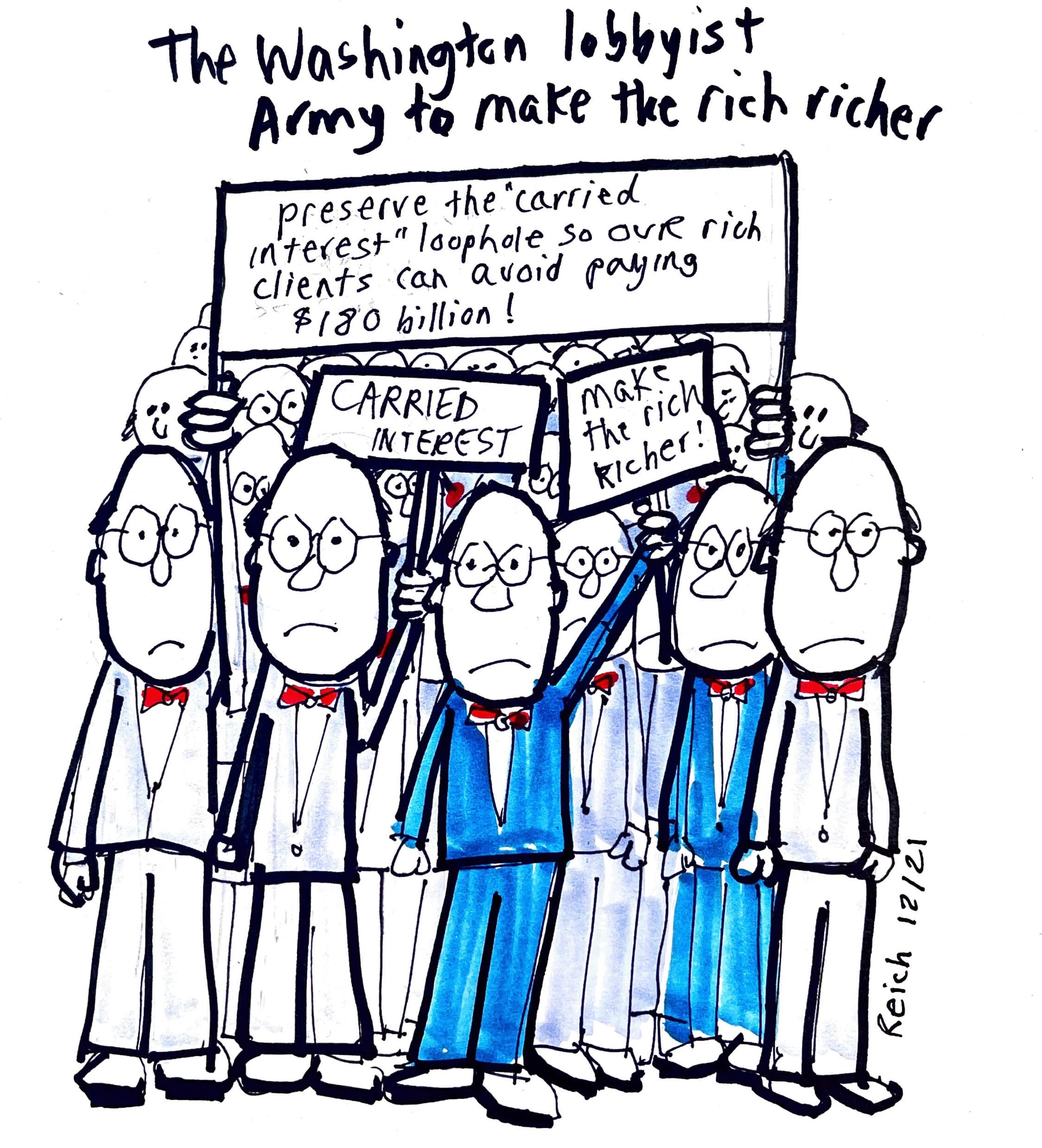

Some view this tax preference as an unfair market-distorting loophole.

. For instance say a Hedge Fund invested in. The carried interest loophole. On August 5 2021 Senate Finance Committee Chairman Ron Wyden D-OR and Senate Finance Committee member Sheldon Whitehouse D-RI introduced the Ending the.

The carried interest loophole is unfair to everyone except the fabulously rich who benefit from it Photograph. The Carried Interest Fairness Act would clarify that this. Kevin LamarqueReuters Tue 14 Dec 2021 0610 EST Last.

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains. Politicians from both parties often view carried interest as a tax loophole that overwhelmingly benefits wealthy investors.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. For years President Trump promised to close the carried interest tax loophole but failed to do so. Many politicians want to close the carried interest tax loophole for private equity managers.

Absent the carried interest loophole high earning investment managers would otherwise pay up to a 396 tax rate. July 15 2016. The lawmakers provided this example.

For 100 years since. In 2017 Senate Republicans rejected an amendment to their tax bill introduced. The best summation comes from the Patriotic Millionaires who said.

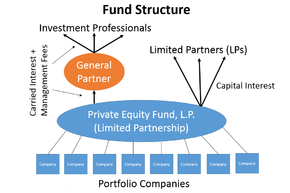

Obama Bush and Trump all want to eliminate the same carried-interest tax loophole. This is a loophole that should absolutely be closed. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

T he person most responsible for inspiring the movement against the carried-interest tax loophole is Victor Fleischer a tax-law professor at the University of San Diego. If you hear the phrase Carried Interest Loophole you could think it allows someone to pay taxes on earned interest at a later date like a 401k plan. In fact during the 2016 presidential campaign both.

The carried interest loophole is an absurd mischaracterization of income that allows about 5000 of the. Best Mortgage Lenders Independently researched and ranked. This creates a controversy that carried interest is a tax loophole.

During the last presidential election both Donald Trump and Hillary Clinton vowed to end carried interest. Bernstein on carried interest tax break. In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the.

If youre a hedge fund manager venture capitalist or partner in a private equity firm the carried interest loophole. Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they. Its so absurd that politicians on both sides of the aisle agree that it should be closed.

The only problem is no such loophole exists. Carried Interest Fairness Act of 2019 HR1735 S781 This legislation introduced in the 115th Congress closes the carried interest loophole which currently allows billionaire Wall Street. 2 days agoIf capital gains are carved out of the surcharge the carried interest loophole becomes even more lucrative because the top tax rate for capital gains would be 25.

The tax treatment of carried interest has been in the news lately following remarks by presidential candidate Donald Trump calling for higher tax rates on hedge fund managers. The carried interest tax loophole is the poster child for the corrupting influence of money in politics. WASHINGTON Fierce lobbying by the private equity industry is the reason the.

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

What Is The Carried Interest Tax Loophole

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Carried Interest In Private Equity Calculations Top Examples Accounting

Treasury To Issue Carried Interest Regulations Closing Perceived S Corporation Loophole Butler Snow

Tax Loopholes That Could Save You Money Smartasset

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Life Events Getting Ahead Napkin Finance

Hedge Papers No 60 New Jersey Hedge Funds And Their Billion Dollar Tax Loophole Hedge Funds Laquo Topic Laquo Hedgepapers Hedge Clippers

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University